oregon tax payment extension

There is no state-specific form to request an extension. You can pay tax penalties and interest.

Tax Fairness Oregon We Read The Bills And Follow The Money

Cookies are required to use this site.

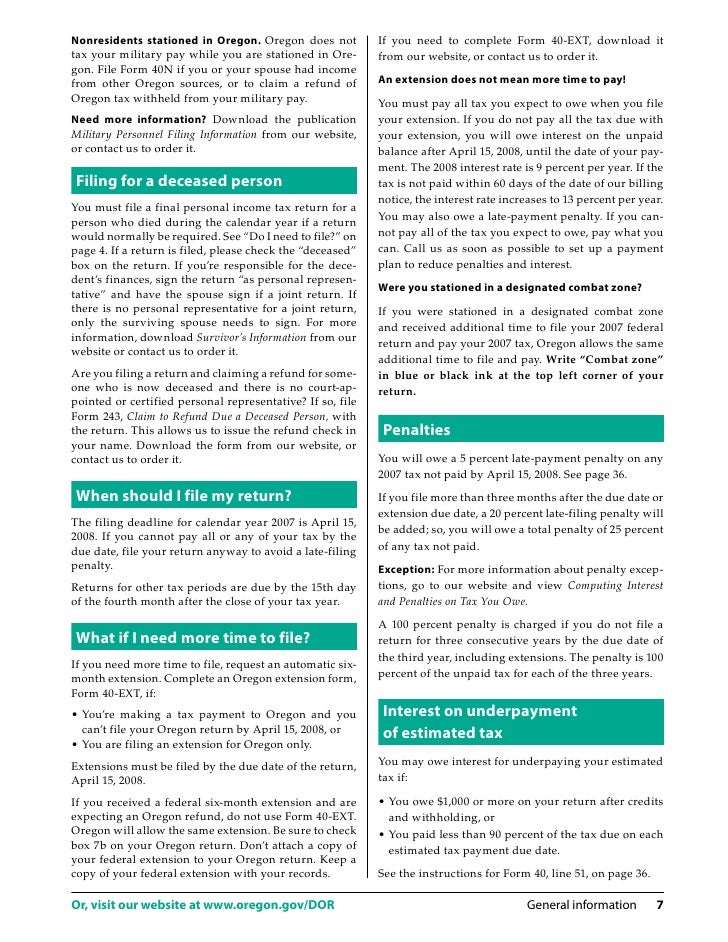

. Those needing additional time to file beyond the May 17 deadline can request a filing extension until October 15 by filing federal Form 4868 through their tax professional or. File your tax return anyway to avoid penalties. You must also mail your tax return by the original due date or by the extended due date if a valid extension is attached.

Write your daytime phone number and. Electronic payment using Revenue Online. Fax your completed business tax return s and supporting tax pages or extension request to.

Choose to pay directly from your bank account or by credit card. Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply. Pay what you can by the due date of the return.

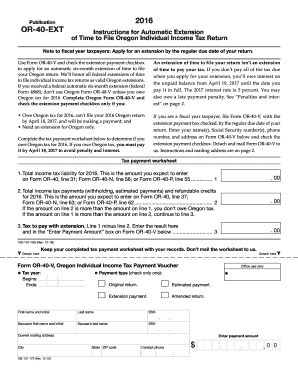

To file your personal income tax return s online you will need. Or Form OR-40-P line 58. Along with the extension form send a check or money order in the amount of the estimated tax due made payable to Oregon Department of Revenue.

Form OR-40-N line 59. Oregon individual income tax returns are due by April 15 in most years. All Oregon residents and businesses are required to file annual City of Oregon income tax returns as well as any businesses with net profit or loss earned within the city.

Individuals in Oregon need to file Form OR-40-EXT with the state to get a 6-month extension of time to file their personal income tax returns Form OR-40 with the state. In accordance with ORS 305157 the director of the Oregon Department of Revenue DOR ordered an automatic extension of the 2019 tax year income tax filing and. Service provider fees may apply.

If you fax your business tax return to us but need to make a tax return. The 2021 tax deadline. If you cannot file by that date you can get a state tax extension.

Businesses can file a federal Form 7004 to obtain an extension with the state of Oregon. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. Form W-2 if you had Multnomah country PFA or Metro SHS tax withheld from your wages.

An Oregon personal extension will give you 6 more. Call us at 503 945-8200 to discuss your debt and options. When filing an Oregon tax return for 2021 include your extension payment as an estimated payment on Form OR-40 line 34.

A tax extension gives you more time to file but not more time to pay. Corporate Income and Excise. Your browser appears to have cookies disabled.

Tax Considerations For Those Impacted By Wildfire Or Other Natural Disasters Recorded Osu Extension Service

Are Oregon Taxes Due On April 15 State Still Undecided Whether To Follow Irs Deadline Extension Oregonlive Com

State Of Oregon Form 41 Year 2018 Fill Out Sign Online Dochub

Filing An Extension Artemis Tax

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Oregon Fraudulent Tax Returns Seek Millions In Refunds Kpic

Oregon Kicker Tax Credit Hits Nearly 1 9 Billion How Much Will You See Kpic

On Tax Day An Extension May Be Better Than Rushing A Return

Oregon Minimum Wage Rate Update Datatech

Egov Oregon Gov Dor Pertax 101 154 07

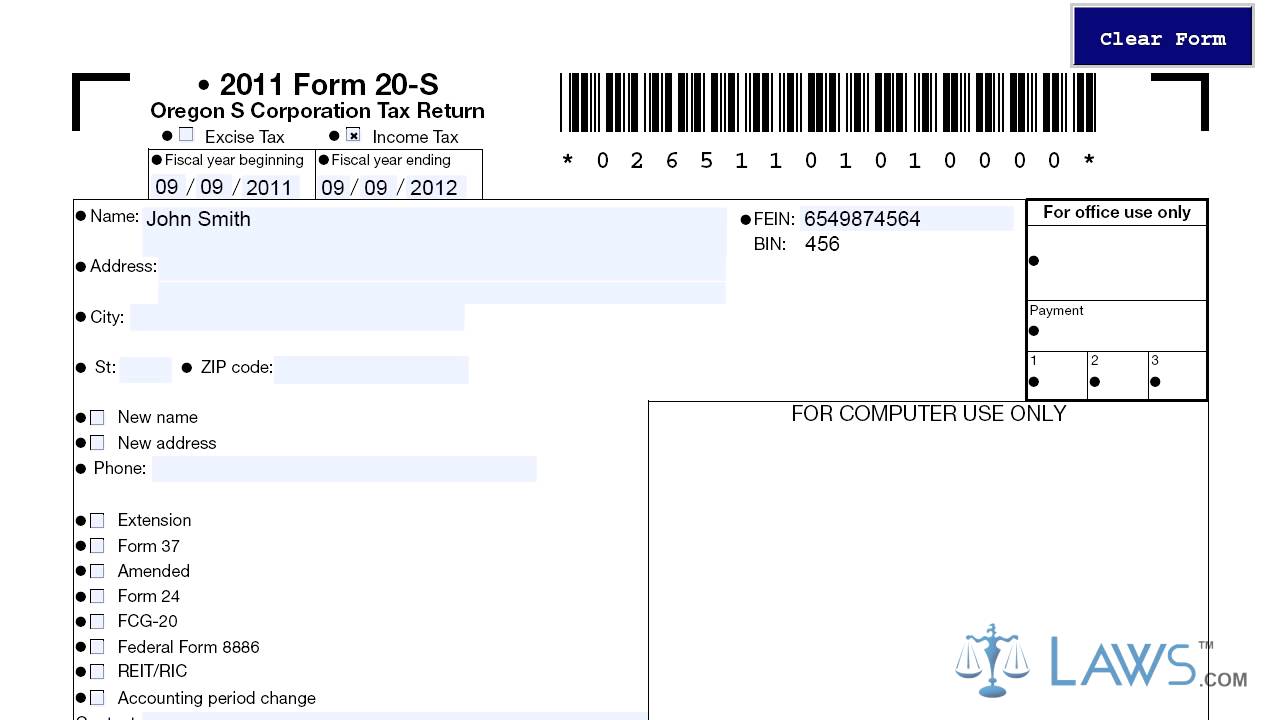

Form 20 S Oregon S Corporation Tax Return Youtube

Oregon Expects One Million Tax Returns In Next Two Weeks News Radio 1190 Kex Portland Local News

Oregon Form 40x Fill Out Sign Online Dochub

Time Running Out For Oregon Families To Get Life Changing Monthly Payments Oregon Capital Chronicle

Tax Fairness Oregon We Read The Bills And Follow The Money

Tax Extensions By States Automatic Extensions In 2022 Pay

Egov Oregon Gov Dor Pertax 101 043 07

Oregon Kicker Tax Credit Hits Nearly 1 9 Billion How Much Will You See Katu

Form 40 Esv Instructions Oregon 40 V Income Tax Payment Voucher 150 101 026 Fill Out And Sign Printable Pdf Template Signnow